What is a Payment Gateway? How To Choose The Payment Gateway Provider?

- Jun 03, 2020

Technology Benefits

What Is A Payment Gateway?

Payment Gateway is the software that mainly authorizes as well as process the payments online. Usually, the payment gateway serves as the main portal that facilitates the transaction and flow between the merchants and customers.

Payment gateway mainly uses cybersecurity protocols as well as encryption for passing transactions on data safety. Data could be principally transferred from the application, mobile devices, or even the website for payment processors or banks.

Payment Gateway works as a third party between the payee and payer.

Digital Transformation and automation are the examples of benefits of adding technology to business and these have made businesses run smoothly by creating easy channels for their customers to reach out to their products and services.

Today, internet usage has been highly increased and become part of our daily lives. Smartphones and various mobile apps have made it very convenient for us to search, compare, order, and pay for products online.

Making Transaction online (by using any of the net banking, debit card, credit card, UPI, and wallets) is a fast and convenient method to pay.

If you have an e-commerce portal, paying online becomes the most fundamental feature of your e-commerce website or portal and provides you a better facility with the integration of the payment gateway.

Online payments are the most convenient and swift way of sending money by allowing them to buy the product or service. When you are a seller, it is a much easier option for selling the products to anyone across the world using online access.

How To Choose The Payment Gateway Provider?

According to recent research, about 86% of the customers have been making online purchases through Debit cards and Credit cards. More than 60% of people consider it as a secure and favorite payment method to make an online purchase.

The payment gateway is not only helpful for transferring the money but also gives you more benefits. The payment gateway has typically the appropriate codes that interfere with the shopping cart using the credit card company. This would be helping process the Credit cards and also ensure the payment is made.

These mainly act as the connecting doors for the transaction automatically. Before choosing the payment gateway, it is essential to consider the following factors:

- What will be the service cost?

- What are the features provided?

- Is it compulsory to have a merchant account?

- Does payment gateway support an online store’s country?

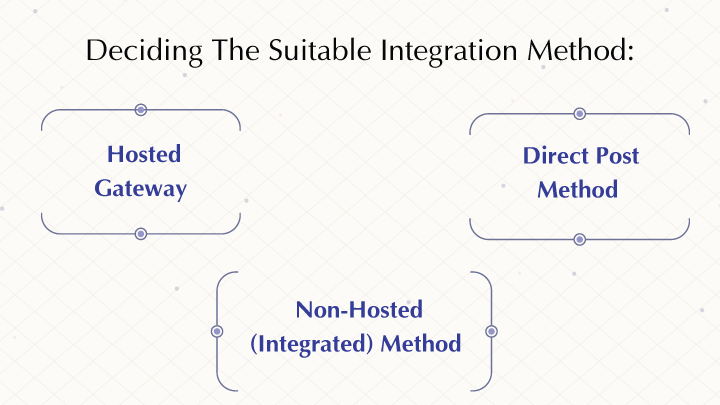

Deciding The Suitable Payment Gateway Integration Method:

Usually, there are 3 important methods available for integrating the Payment Gateway.

Hosted Gateway – Hosted payment gateway is 3rd party and requires customers to leave the website for making their purchase.

Direct Post Method – The Direct Post process is the integration method allowing the customers for shopping even without leaving the website. No need to obtain PCI compliance.

Non-Hosted (Integrated) Method – The integrated payment gateway allows keeping the user on the website for buying products. The Non-hosted payment gateway providers are integrating via APIs.

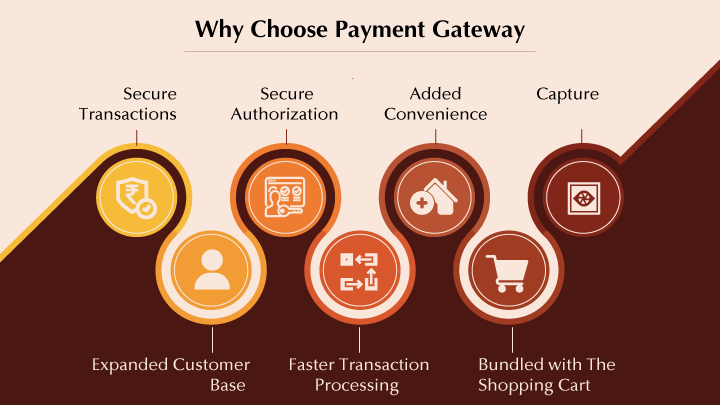

Why Choose a Payment Gateway?

The trend towards merchant account providers gives you a much more efficient option for the payment gateway service. Below are the reasons for getting Payment Gateway

- Secure Transactions – Utilizes industry-standard encryption with protecting sensitive data.

- Expanded Customer Base – Payment gateways give you the shopper for accessing the store to expand the customer base.

- Bundled with The Shopping Cart – The Payment gateways mainly bundles the shopping cart software on programs.

- Faster Transaction Processing – Payment gateway is much faster compared to manual processing.

- Added Convenience – The Payment gateway allows your store to open access 24/7 easily. Customers could easily shop for an hour the day and night with more comfort.

- Secure Authorization – Transactions could be used for checking the customer for funding the payment. Merchant mainly ensures cardholders who are capable of paying for the ordered item.

- Capture – the processing of the authorized payment could mainly result in the funds for sending the merchant’s account.

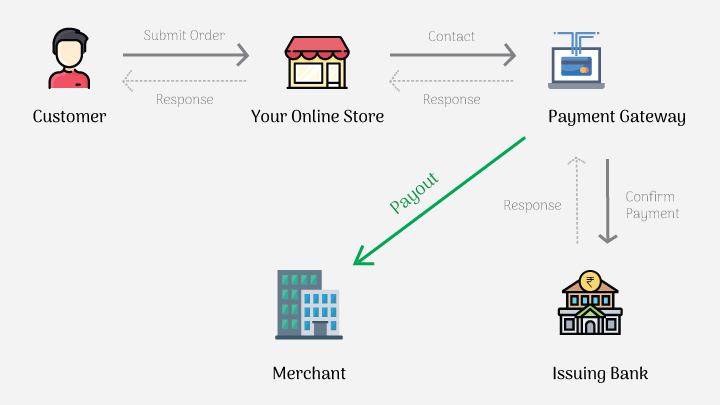

How Does Payment Gateway Work?

Payment Gateway (PG) online is the tunnel that mainly connects the bank account in the platform, so that it is a much more efficient option for transferring money.

A payment gateway authorizes mostly the user to efficiently conduct online transactions even with the different payment modes such as credit card, debit card, net banking, UPI, and many other online wallets available.

Payment Gateway mainly assures the secure transfer of the money even from the Bank account for the payment portal of the merchant.

- Collection - Customer chooses product or services to purchase.

- Authentication - payment gateway collects information then verifies entered information.

- Authorization - The bank verifies checking card credentials by checking the funds. Bank authorizes transaction resulting in displaying the “Approved” or “Rejected”.

- Settlement – The bank makes the required payment to the payment gateway for the transaction to the Merchant bank account based on settlement.

Top Payment Gateways in India are:-

- Citrus Pay Payment Gateway

- CC Avenue Payment Gateway

- PayUBiz India Payment Gateway

- BillDesk Payment Gateway

- Razorpay Payment Gateway

- PayPal Payment Gateway

- Atom Paynetz Payment Gateway

- Paytm Payment Gateway

- DirectPay Payment Gateway

- Cashfree Payment Gateway

Conclusion

Payment gateway gives your customer the freedom to pay online at their convenience at any time 24X7. In eCommerce, it gives the seller an opportunity to showcase the products and services globally as it processes the payment from all over the world and even from various modes like debit cards, credit cards, net banking, wallets, etc.

So whether you are an eCommerce Company or not, the payment gateway to your website, software, or mobile app is recommended for the reason of convenience and security.

Leave a Comment

Your Phone Number will not be published.